Small Business Health Insurance Explained: A Guide for Startups sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. It delves into the complexities of health insurance for small businesses, shedding light on key aspects that startups need to navigate in this vital area.

As we unravel the layers of small business health insurance, we uncover a world of choices, considerations, and strategies that can impact both business owners and employees alike.

Introduction to Small Business Health Insurance

Small business health insurance refers to health coverage provided by employers to their employees in small businesses. This type of insurance helps cover medical expenses and ensures access to healthcare services for employees.

The Importance of Offering Health Insurance for Startups

Offering health insurance is crucial for startups as it plays a significant role in attracting and retaining top talent. It demonstrates a commitment to employee well-being and can contribute to a positive work environment.

The Benefits of Small Business Health Insurance for Employees

- Access to Healthcare: Employees can receive necessary medical care without worrying about high out-of-pocket costs.

- Financial Protection: Health insurance helps protect employees from unexpected medical expenses that could otherwise lead to financial strain.

- Wellness Programs: Some health insurance plans offer wellness programs that promote healthy lifestyles and preventive care.

- Piece of Mind: Knowing that they have health insurance coverage can give employees peace of mind and reduce stress related to healthcare costs.

Types of Small Business Health Insurance Plans

When it comes to providing health insurance for your small business, there are different types of plans to consider. Understanding the options available can help you make the best decision for your company and employees.

Group Health Insurance

Group health insurance is a common option for small businesses. This type of plan provides coverage for a group of employees, typically at a lower cost than individual plans. Group health insurance often offers a range of benefits and coverage options, making it an attractive choice for employers looking to provide comprehensive health insurance for their employees.

Individual Health Insurance

Individual health insurance is purchased by individuals to cover themselves and their families. While not typically offered by small businesses as a group plan, some small businesses may choose to reimburse employees for individual health insurance premiums. Individual health insurance plans offer flexibility and choice, allowing employees to select a plan that meets their specific needs.

Popular Health Insurance Providers for Small Businesses

There are several health insurance providers that cater to small businesses, offering a variety of plans and coverage options. Some popular providers include:

Blue Cross Blue Shield

Known for its wide network of doctors and hospitals, Blue Cross Blue Shield offers a range of health insurance plans for small businesses.

Aetna

Aetna provides customizable health insurance plans tailored to the needs of small businesses, with options for both group and individual coverage.

UnitedHealthcare

UnitedHealthcare offers small business health insurance plans with a focus on wellness programs and preventive care, helping employees stay healthy and productive.These are just a few examples of health insurance providers that small businesses can consider when choosing a plan for their employees.

It's important to compare options and consider factors such as cost, coverage, and network size to find the best fit for your business.

Factors to Consider When Choosing a Health Insurance Plan

When selecting a health insurance plan for your startup, it is crucial to consider various factors to ensure you are providing the best coverage for your employees while managing costs effectively.

Business Size Impact

The size of your business plays a significant role in determining the type of health insurance plan that would be most suitable. Smaller businesses may opt for more affordable plans with basic coverage, while larger businesses may have the resources to offer comprehensive plans with additional benefits.

Coverage Options

- Medical Coverage: Ensure the plan includes coverage for essential medical services such as doctor visits, hospital stays, and prescription drugs.

- Dental Coverage: Consider adding dental coverage to promote overall health and well-being among your employees.

- Vision Coverage: Including vision coverage can help employees access eye care services and maintain good vision health.

- Additional Benefits: Evaluate options for additional benefits such as mental health services, wellness programs, and telemedicine to support the overall well-being of your employees.

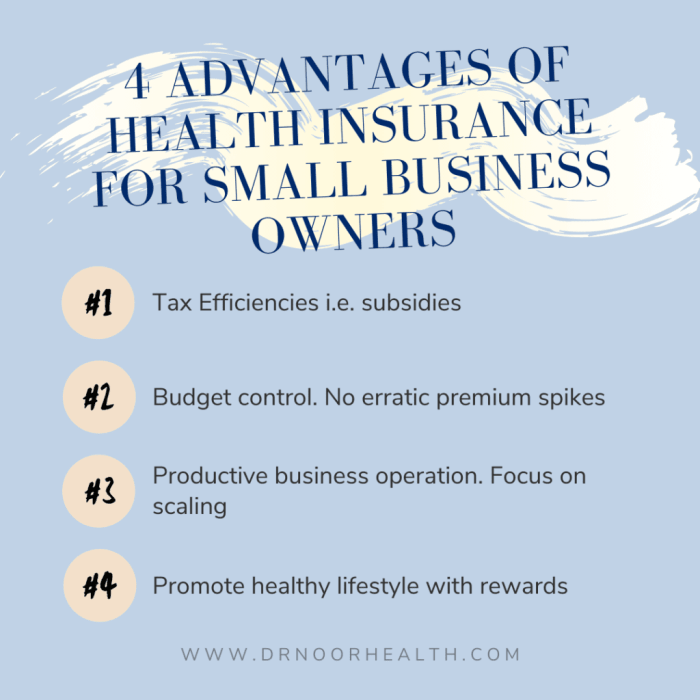

Cost Management Strategies for Small Business Health Insurance

When it comes to small business health insurance, managing costs effectively is crucial for startups. By implementing cost-saving strategies and finding the right balance between expenses and coverage, businesses can ensure the well-being of their employees without breaking the bank.

Employee Contributions and Employer Subsidies

Employee contributions and employer subsidies play a significant role in managing the costs of health insurance for small businesses. Here are some key points to consider:

- Encourage employees to contribute to their health insurance premiums - this can help offset some of the costs for the employer.

- Offering employer subsidies can make health insurance more affordable for employees, fostering loyalty and retention.

- Discuss with your insurance provider the possibility of cost-sharing arrangements to distribute expenses between the employer and employees.

Balancing Cost and Coverage

It's essential to strike a balance between cost and coverage to ensure that both the business and its employees are adequately protected. Consider the following tips:

- Assess the specific healthcare needs of your employees to avoid overpaying for unnecessary coverage.

- Compare different health insurance plans to find the most cost-effective option without compromising on essential benefits.

- Explore alternative insurance models like Health Savings Accounts (HSAs) or Health Reimbursement Arrangements (HRAs) to control costs while providing adequate coverage.

Compliance and Legal Requirements

When it comes to offering health insurance for small businesses, there are specific legal requirements and regulations that must be followed. Understanding these requirements is crucial to ensure compliance and avoid any potential legal issues.The Affordable Care Act (ACA) has had a significant impact on small business health insurance.

This legislation introduced various provisions that affect how small businesses can provide health insurance to their employees. It is essential for small business owners to be aware of the implications of the ACA and ensure that they are compliant with its regulations.

State and Federal Laws Compliance

In order to comply with state and federal laws regarding health insurance coverage, small businesses must adhere to certain guidelines. This includes providing certain essential health benefits as mandated by law, such as preventive services, maternity care, and mental health services.

Small businesses must also comply with regulations related to the size of the business, employee eligibility, and contribution requirements.

- Small businesses must ensure that their health insurance plans meet the minimum essential coverage requirements set forth by the ACA.

- Employers are required to provide employees with a summary of benefits and coverage (SBC) that Artikels the key features of the health insurance plan.

- Small businesses must report information about the health insurance coverage they offer to employees to the IRS annually.

- Compliance with state-specific regulations regarding health insurance coverage is also essential for small businesses operating in multiple states.

- Small businesses must comply with regulations related to the Affordable Care Act's employer mandate, which requires certain businesses to provide health insurance to full-time employees or face penalties.

Final Conclusion

In conclusion, Small Business Health Insurance Explained: A Guide for Startups encapsulates the essence of providing health insurance in the startup landscape. It emphasizes the significance of these decisions, guiding both new entrepreneurs and seasoned business owners towards informed choices that can shape the well-being of their ventures and teams.

FAQ Section

What is the minimum number of employees required to qualify for small business health insurance?

Generally, most insurance providers require at least one to two employees to be eligible for small business health insurance plans. However, this can vary depending on the insurer and state regulations.

Are small business health insurance premiums tax-deductible?

Yes, in most cases, premiums paid for small business health insurance are tax-deductible as a business expense. This can provide significant tax benefits to startups offering health insurance to their employees.

Can small businesses offer health insurance to part-time employees?

Yes, small businesses have the option to offer health insurance to part-time employees, but the eligibility criteria and coverage options may vary based on the insurance provider and the specific plan chosen.