Exploring the world of Online Payroll Solutions That Save Time and Money for Small Teams, this introduction sets the stage for an informative and engaging discussion. Dive into the realm of streamlining payroll processes and maximizing efficiency for small teams.

Detailing the key features and integrations that can revolutionize the payroll landscape, this overview aims to provide valuable insights for businesses looking to enhance their financial management systems.

Benefits of Online Payroll Solutions for Small Teams

Online payroll solutions offer numerous advantages for small teams, helping to streamline payroll processes, save time, and reduce costs significantly. These benefits make them essential tools for businesses looking to improve efficiency and accuracy in managing payroll.

Saving Time

- Automation: Online payroll solutions automate tedious tasks such as calculating wages, taxes, and deductions, saving valuable time for small teams.

- Self-Service: Employees can access their payroll information, update personal details, and view pay stubs online without requiring HR intervention, reducing administrative burden.

- Integration: Many online payroll platforms integrate seamlessly with accounting software, eliminating the need for manual data entry and reducing the risk of errors.

Saving Money

- Cost-Effective: Online payroll solutions are typically more cost-effective than traditional payroll methods, reducing the need for dedicated payroll staff or outsourcing services.

- Compliance: Automated tax calculations and filings help small teams avoid costly penalties and fines for non-compliance with tax regulations.

- Error Reduction: By automating payroll processes, online solutions minimize the risk of costly errors in wage calculations or tax filings.

Streamlined Processes

- Direct Deposit: Online payroll platforms offer direct deposit options, eliminating the need for paper checks and reducing administrative costs associated with printing and distributing pay stubs.

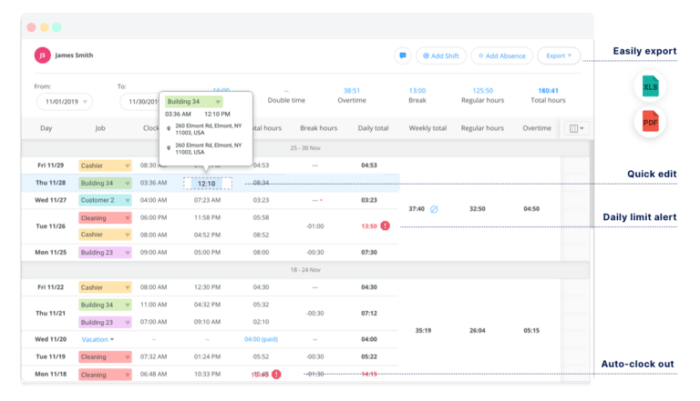

- Reporting Tools: Advanced reporting features in online payroll solutions provide valuable insights into labor costs, employee hours, and tax liabilities, enabling small teams to make informed decisions.

- Mobile Accessibility: Many online payroll solutions offer mobile apps, allowing employees and employers to access payroll information on the go, increasing flexibility and convenience.

Key Features to Look for in Online Payroll Solutions

When choosing an online payroll solution for small teams, it is essential to consider key features that will streamline payroll tasks and save time. Different online payroll tools offer various functionalities, so comparing them based on these features is crucial to find the most suitable option for your team.

Here are some must-have features to look for:

1. Automated Payroll Processing

Automated payroll processing eliminates the need for manual calculations and reduces the risk of errors. Look for a solution that can automatically calculate salaries, deductions, and taxes based on the latest regulations.

2. Employee Self-Service Portal

An employee self-service portal allows team members to access their payroll information, view pay stubs, update personal details, and submit time-off requests. This feature empowers employees and reduces the administrative burden on HR staff.

3. Tax Filing and Compliance

Ensure the online payroll solution can handle tax filing and compliance tasks, including generating and filing tax forms accurately and on time. This feature helps small teams stay compliant with regulations and avoid penalties.

4. Integration with Accounting Software

Look for a payroll solution that seamlessly integrates with accounting software to streamline financial processes. This integration ensures that payroll data is accurately reflected in financial reports and simplifies reconciliation tasks.

5. Mobile Accessibility

Choose a payroll solution that offers mobile accessibility, allowing team members to access payroll information and complete tasks on-the-go. This feature enhances flexibility and convenience for both employees and administrators.

6. Customizable Reporting

Customizable reporting features enable small teams to generate tailored reports to analyze payroll data, track expenses, and make informed decisions. Look for a solution that offers a variety of report templates and customization options.

7. Security and Data Protection

Prioritize the security of sensitive payroll data by selecting a solution that offers robust security measures, such as encryption, two-factor authentication, and regular data backups

8. Scalability

Consider the scalability of the online payroll solution to accommodate the growth of your small team. Ensure that the solution can handle an increasing number of employees and adapt to changing payroll needs without compromising efficiency.

9. Customer Support

Lastly, evaluate the customer support options provided by the payroll solution provider. Responsive customer support can help resolve issues quickly and ensure smooth payroll operations for small teams.

Integrations with Accounting Software

Integrating online payroll solutions with accounting software is crucial for small teams to streamline financial management processes.

Popular Accounting Software for Integration

- QuickBooks: Widely used accounting software that seamlessly integrates with many online payroll solutions, allowing for easy transfer of payroll data.

- Xero: Another popular choice for small businesses, offering integration with various online payroll platforms for efficient data syncing.

- FreshBooks: Known for its user-friendly interface, FreshBooks can integrate with online payroll solutions to automate financial tasks.

Improving Efficiency with Integration

Integration between payroll and accounting software can significantly enhance overall efficiency for small teams. By syncing data between the two systems, businesses can eliminate manual data entry errors and ensure accurate financial records. This integration also enables real-time tracking of expenses, payroll costs, and tax liabilities, providing better insights for informed decision-making.

Security Measures in Online Payroll Solutions

Ensuring the security of sensitive employee data is crucial when it comes to using online payroll solutions for small teams. These platforms handle a wealth of personal information and financial data, making them a prime target for cyber threats.

Checklist of Security Features

- Encryption: Look for a payroll solution that uses encryption to protect data both in transit and at rest. This ensures that information is secure and unreadable to unauthorized users.

- Two-Factor Authentication: Implementing two-factor authentication adds an extra layer of security by requiring users to provide two forms of verification before accessing the system.

- Regular Backups: Choose a payroll solution that performs regular backups of data to prevent loss in case of a cyber attack or system failure.

- Role-Based Access Control: Restrict access to sensitive payroll information based on roles within the organization to minimize the risk of data breaches.

- Audit Trails: Opt for a platform that keeps detailed audit trails to track any changes made to payroll data and identify any suspicious activity.

Best Practices for Data Security

- Employee Training: Educate your team on best practices for data security, such as creating strong passwords and recognizing phishing attempts.

- Regular Updates: Ensure that the payroll solution is regularly updated with the latest security patches to protect against vulnerabilities.

- Monitor Access: Keep track of who has access to the payroll system and revoke access for employees who no longer require it.

- Vendor Due Diligence: Before selecting an online payroll solution, conduct thorough research on the vendor's security measures and certifications.

End of Discussion

In conclusion, Online Payroll Solutions That Save Time and Money for Small Teams offer a transformative approach to payroll management, emphasizing efficiency and cost-effectiveness. With the right tools and integrations, small teams can streamline their processes and focus on growth and success.

Question & Answer Hub

How can online payroll solutions save time for small teams?

Online payroll solutions automate manual tasks, such as calculations and tax filings, saving time and reducing errors.

What are some essential features to look for in online payroll solutions for small teams?

Key features include automatic payroll processing, tax compliance tools, and employee self-service portals.

Why is integration with accounting software important for online payroll solutions?

Integration with accounting software ensures seamless financial management and accurate reporting across different systems.

What security measures should small teams look for in online payroll solutions?

Security features like data encryption, multi-factor authentication, and regular audits are crucial for protecting sensitive employee data.