Delving into Comparing Business Health Plans: Which One is Right for You?, this introduction immerses readers in a unique and compelling narrative. It provides a comprehensive overview of different health plans available for businesses, factors to consider when choosing a plan, costs involved, network coverage, and employee preferences.

By the end of this discussion, you will have a clearer understanding of which business health plan aligns best with your needs.

Understanding Different Types of Business Health Plans

When it comes to choosing a health plan for your business, it's essential to understand the different types available and how they cater to the varying needs of businesses.

Traditional Health Insurance Plans

Traditional health insurance plans are the most common type offered to businesses. These plans typically involve a network of healthcare providers and offer coverage for a wide range of medical services. Employees usually pay a portion of the premium, with the employer covering the rest.

The key benefit of traditional health insurance plans is the flexibility to choose healthcare providers and services.

High-Deductible Health Plans (HDHP)

High-deductible health plans are becoming increasingly popular among businesses due to their lower premiums. These plans have higher deductibles than traditional plans, meaning employees must pay more out of pocket before insurance coverage kicks in. However, HDHPs are often paired with Health Savings Accounts (HSAs) or Health Reimbursement Arrangements (HRAs) that allow employees to save for medical expenses tax-free.

HDHPs are ideal for businesses looking to save on premiums and encourage employees to be more cost-conscious about their healthcare choices.

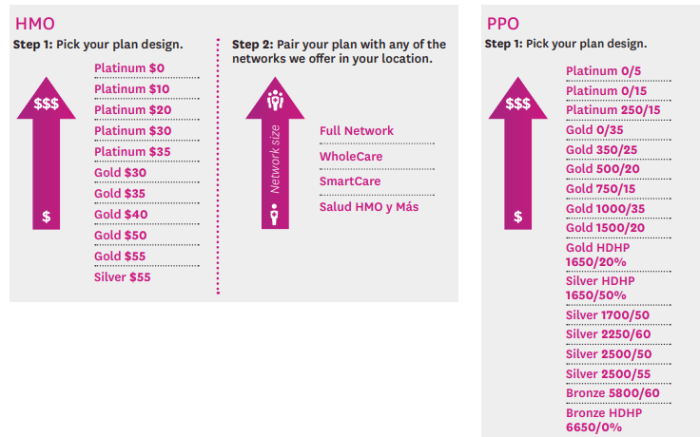

Preferred Provider Organization (PPO) Plans

PPO plans offer a network of preferred healthcare providers that employees can choose from. Employees have the flexibility to see out-of-network providers but will pay more out of pocket. PPO plans do not require referrals to see specialists, making them convenient for employees who want more control over their healthcare decisions.

These plans are suitable for businesses that want to offer employees a balance between cost and flexibility.

Health Maintenance Organization (HMO) Plans

HMO plans require employees to choose a primary care physician (PCP) who manages their care and provides referrals to specialists within the network. HMO plans typically have lower out-of-pocket costs but limit the choice of healthcare providers. These plans are best suited for businesses looking to control costs and prioritize preventive care for their employees.

Point of Service (POS) Plans

POS plans combine features of HMO and PPO plans, giving employees the flexibility to choose in-network or out-of-network providers. Employees may need a referral from their PCP to see a specialist, but they have the option to seek care outside the network at a higher cost.

POS plans are ideal for businesses that want to offer employees a balance between cost savings and provider choice.

Factors to Consider When Choosing a Business Health Plan

When selecting a health plan for your business, there are several key factors to consider to ensure you make the right choice for your company and employees.

Company Size and Industry Influence

The size of your company and the industry you operate in can significantly impact the type of health plan that suits your needs. Smaller businesses may opt for more affordable plans with limited coverage, while larger companies might require comprehensive plans to meet the needs of a larger workforce.

Additionally, certain industries may have specific health concerns that need to be addressed through tailored health plans.

Cost Considerations

Cost is a crucial factor when choosing a business health plan. Evaluate your budget and consider the premium costs, deductibles, co-pays, and out-of-pocket expenses associated with each plan. Balance the cost with the level of coverage provided to ensure that you are getting the best value for your investment.

Coverage Options

Consider the coverage options offered by different health plans. Look at the network of healthcare providers, prescription drug coverage, preventive care services, and additional benefits like mental health or maternity care. Choose a plan that aligns with the healthcare needs of your employees and provides comprehensive coverage for a range of medical services.

Employee Needs

Understanding the healthcare needs of your employees is essential when selecting a business health plan. Consider factors such as age demographics, existing health conditions, family size, and preferences for healthcare providers. Tailoring the health plan to meet the specific needs of your workforce can lead to higher employee satisfaction and better health outcomes.

Comparing Costs of Business Health Plans

When choosing a business health plan, one of the most critical factors to consider is the cost

Cost Comparison Table

| Health Plan | Premiums | Deductibles | Copayments | Out-of-Pocket Maximums |

|---|---|---|---|---|

| Plan A | $500/month | $1,000 | $20 per visit | $5,000 |

| Plan B | $600/month | $1,500 | $30 per visit | $6,000 |

| Plan C | $450/month | $2,000 | $25 per visit | $4,500 |

Cost structures can vary significantly between health plans. Some plans may have lower monthly premiums but higher deductibles, while others may have higher premiums but lower out-of-pocket costs. Businesses should consider their budget, employee needs, and overall health care usage when comparing costs to ensure they select a plan that provides adequate coverage without excessive expenses.

Evaluating Network Coverage and Provider Options

When choosing a business health plan, it is crucial to evaluate the network coverage and provider options available. This can greatly impact the accessibility and quality of healthcare services for employees.

Comparing Network Coverage

- Some business health plans have a larger network of doctors and healthcare facilities, providing employees with more options for their healthcare needs.

- Other plans may have a more limited network, which could result in employees having to travel further or pay out-of-network costs for certain services.

- Consider the geographical coverage of the network to ensure that employees have access to healthcare providers in their area.

Assessing Provider Options

- Look into the types of healthcare providers included in the network, such as primary care physicians, specialists, hospitals, and clinics.

- Check if the plan allows employees to see their preferred doctors or if they need referrals to access certain specialists.

- Evaluate the quality of the providers in the network by researching their credentials, ratings, and patient reviews.

Impact on Access to Healthcare

- A robust network coverage can ensure that employees have easy access to a variety of healthcare services without incurring additional costs.

- Limited provider options may lead to delays in receiving care or result in employees seeking treatment outside the network, which can be more expensive.

- Choosing a business health plan with a well-rounded network can improve employee satisfaction and overall health outcomes.

Understanding Employee Preferences and Needs

When it comes to selecting a business health plan, understanding the health needs and preferences of your employees is crucial. By catering to their specific requirements, you can ensure that the chosen plan meets their expectations and provides adequate coverage.

Assessing Employee Health Needs

Before choosing a health plan for your employees, it is essential to assess their health needs. This can be done through surveys, health assessments, and discussions with healthcare providers. By understanding their medical history, current health conditions, and potential future needs, you can tailor the plan to meet their requirements.

Incorporating Employee Feedback

Employee feedback is invaluable when selecting a health plan. Encourage open communication and gather input from your team regarding their preferences and experiences with past health plans. By incorporating their feedback, you can choose a plan that resonates with your employees and addresses their concerns.

Importance of Employee Satisfaction and Retention

Employee satisfaction and retention are closely linked to the benefits provided by their employer, including health plans. Offering comprehensive health coverage not only demonstrates care for your employees' well-being but also contributes to higher job satisfaction and increased loyalty. By prioritizing employee health needs, you can enhance overall satisfaction and retention rates within your organization.

Last Word

In conclusion, comparing business health plans is a crucial decision for any organization. Understanding the various types of plans, considering key factors, evaluating costs, network coverage, and employee preferences are all essential elements to make an informed choice. By prioritizing your company's specific needs and taking into account employee well-being, you can select a health plan that not only meets regulatory requirements but also fosters a healthy and productive work environment.

Detailed FAQs

Are there any tax benefits associated with offering health plans to employees?

Yes, businesses can typically deduct the cost of providing health insurance to employees as a business expense, which can result in tax savings.

How does the size of a company impact the choice of a health plan?

Company size can influence the type of health plans available, with larger companies often having more options due to economies of scale, while smaller companies may opt for more affordable plans.

What role does employee feedback play in choosing a business health plan?

Employee feedback is crucial as it helps tailor the health plan to better meet the needs and preferences of the workforce, ultimately leading to higher satisfaction and retention rates.