In the fast-paced world of small business ownership, having the best payroll services in 2025 is crucial for success. From ensuring accurate financial records to keeping employees satisfied, the right payroll service can make all the difference. Let's dive into the key aspects to consider when choosing the best payroll services for small business owners in 2025.

Importance of Payroll Services

Reliable payroll services are crucial for small businesses to ensure smooth financial operations, compliance with regulations, and employee satisfaction.

Streamlining Financial Processes

- Accurate payroll services help small business owners automate calculations, tax deductions, and direct deposits, saving time and reducing errors.

- By streamlining financial processes, payroll services allow business owners to focus on core operations and strategic growth initiatives.

Contributing to Business Growth and Employee Satisfaction

- Timely and accurate payroll processing can enhance employee satisfaction and retention, leading to a more motivated and productive workforce.

- Proper payroll management ensures compliance with labor laws and regulations, reducing the risk of penalties and legal issues that could hinder business growth.

- By providing detailed reports and insights, payroll services enable business owners to make informed decisions and optimize their financial resources for sustainable growth.

Features to Look for in Payroll Services

When choosing a payroll service for your small business, it is important to consider key features that can streamline your payroll process and ensure compliance with regulations. Here are some features to look for in payroll services:

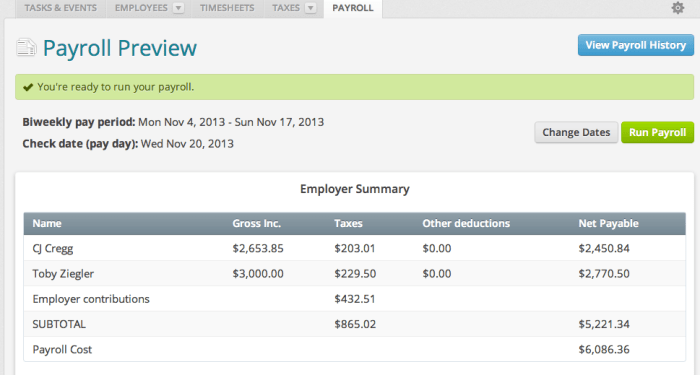

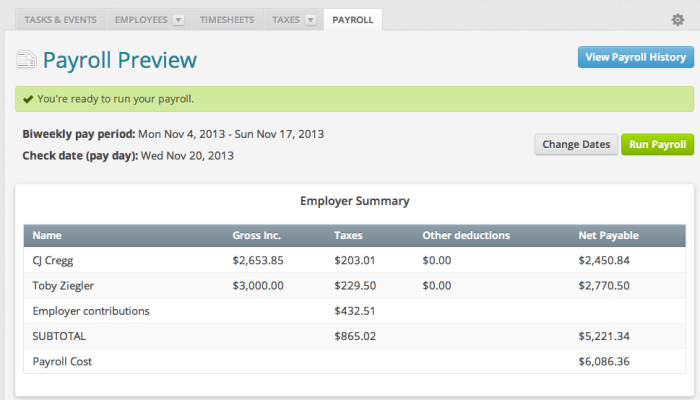

Tax Management

- Automatic calculation of taxes and deductions

- Generation of tax forms and reports

- Filing of payroll taxes with government agencies

Direct Deposit

- Ability to pay employees electronically

- Secure and reliable payment processing

- Convenience for both employers and employees

Compliance Tools

- Alerts and reminders for compliance deadlines

- Integration with labor laws and regulations

- Customizable settings for specific industry requirements

Integration with Accounting Software

- Seamless integration with accounting systems for accurate financial reporting

- Automatic syncing of payroll data with general ledger accounts

- Reduction of manual data entry errors

Emerging Trends in Payroll Services for 2025

The year 2025 is expected to bring significant advancements in payroll services, with the integration of cutting-edge technologies aimed at enhancing security and efficiency for small businesses.AI Integration:Artificial Intelligence (AI) is set to revolutionize payroll processing by automating repetitive tasks, such as data entry and calculations.

AI-powered systems can analyze data faster and more accurately than humans, reducing errors and saving time

By utilizing blockchain for payroll processing, small businesses can ensure data integrity and eliminate the risk of fraud or tampering. Each transaction is securely recorded in a decentralized ledger, providing a reliable audit trail for payroll activities.Biometric Authentication:Biometric authentication methods, such as fingerprint or facial recognition, are becoming more prevalent in payroll services to enhance security.

Small businesses can use biometric data to verify employee identities, ensuring that only authorized personnel can access sensitive payroll information. This reduces the risk of unauthorized access and improves overall data security.Automation and Machine Learning:Automation and machine learning algorithms are streamlining payroll management processes for small business owners.

These technologies can automatically categorize payroll expenses, generate reports, and predict future payroll trends based on historical data. By leveraging automation, small businesses can reduce manual errors, increase efficiency, and focus on strategic decision-making rather than administrative tasks.These emerging trends in payroll services for 2025 are poised to transform the way small businesses handle payroll processing, offering improved security, accuracy, and efficiency in managing employee compensation.

Cost-Effectiveness of Payroll Services

Outsourcing payroll services can be a cost-effective solution for small business owners compared to hiring an in-house payroll team. By outsourcing, businesses can save on expenses related to salaries, benefits, training, and software costs associated with maintaining an internal payroll department.

Tips for Saving Money with Efficient Payroll Services

- Choose a payroll service provider that offers scalable pricing based on the size of your business. This way, you only pay for the services you need.

- Automate payroll processes to reduce the time and resources required to manage payroll tasks manually.

- Ensure compliance with tax regulations to avoid penalties and fines that can add unnecessary costs to your payroll operations.

- Review your payroll service plan regularly to identify any additional services or features that can optimize costs and improve efficiency.

Long-Term Financial Benefits of Quality Payroll Services

Quality payroll services can provide long-term financial benefits for small businesses by ensuring accuracy, compliance, and efficiency in payroll operations. By investing in a reliable payroll service provider, businesses can avoid costly errors, reduce the risk of non-compliance with tax laws, and streamline their payroll processes, ultimately saving time and money in the long run.

Final Wrap-Up

As we wrap up our discussion on the best payroll services for small business owners in 2025, it's clear that the right choice can truly impact the growth and efficiency of a business. By staying informed about emerging trends and cost-effective options, small business owners can set themselves up for success in the ever-changing landscape of payroll services.

Essential Questionnaire

What are the advantages of outsourcing payroll services for small business owners?

Outsourcing payroll services can save time and money for small business owners, allowing them to focus on core business activities.

How can payroll services with AI integration benefit small businesses in 2025?

AI integration can enhance accuracy and efficiency in payroll processing, leading to better decision-making and cost savings.

Are there any compliance tools that small business owners should prioritize in payroll services?

Small business owners should prioritize compliance tools that help them stay up-to-date with changing regulations and avoid costly penalties.